2025 Tax Credits For Heat Pumps. The typical cost of a. Heat pump tax credit up to $2,000.

This can be combined with the remaining $1,200 in credits for other eligible upgrades made within. Ira provides a 30% tax credit for families investing in clean energy systems like solar electricity, solar.

The 2023 Federal Tax Credit For Heat Pumps Is 30% Of The Purchase And Installation Cost, Up To $2,000.

Ira provides a 30% tax credit for families investing in clean energy systems like solar electricity, solar.

Households Looking For Assistance Today May Be Eligible For Other Federal Programs, Including Tax Credits Or The Weatherization Assistance Program.

Learn about the tax credits under the.

2025 Tax Credits For Heat Pumps Images References :

Source: www.youtube.com

Source: www.youtube.com

Tax credits offered for heat pump installation YouTube, What is the typical cost of a heat pump? A heat pump runs on electricity and reduces greenhouse gas emissions.

Source: waterheaternest.com

Source: waterheaternest.com

Optimize Savings with Federal Tax Credits for Heat Pump Water Heaters, Tax credits for heat pumps 2025. Biden’s signature climate law, the inflation reduction act, offers tax credits of up to $2,000 a year for the purchase of heat pumps, devices that can heat and.

Source: www.youtube.com

Source: www.youtube.com

Tax credits offered for heat pump installation YouTube, Tax credits for heat pumps 2025. Learn about the tax credits under the.

Source: homes.rewiringamerica.org

Source: homes.rewiringamerica.org

25C Heat Pump Federal Tax Credits A Guide, A heat pump runs on electricity and reduces greenhouse gas emissions. It includes tax credits for heat pumps, heat pump water heaters, weatherization, electric panel upgrades, solar and battery storage.

Source: askgem.com

Source: askgem.com

Discover Heat Pump Tax Credits GEM Plumbing & Heating, Starting in 2023, the 25c energy efficiency tax credit will give you up to 30% back on of the purchase and installation cost of qualified home upgrades (as well as a few other related energy efficiency tasks, such. Families who install an efficient electric heat pump for heating and cooling can receive a tax credit of up to $2,000 and save an average of $500 per year on.

Source: environmentamerica.org

Source: environmentamerica.org

Heat pumps how federal tax credits can help you get one, Heat pump tax credit up to $2,000. Recent legislation changes mean that upgrading your hvac system may not only save you energy, but also earn you tax credits and rebates.

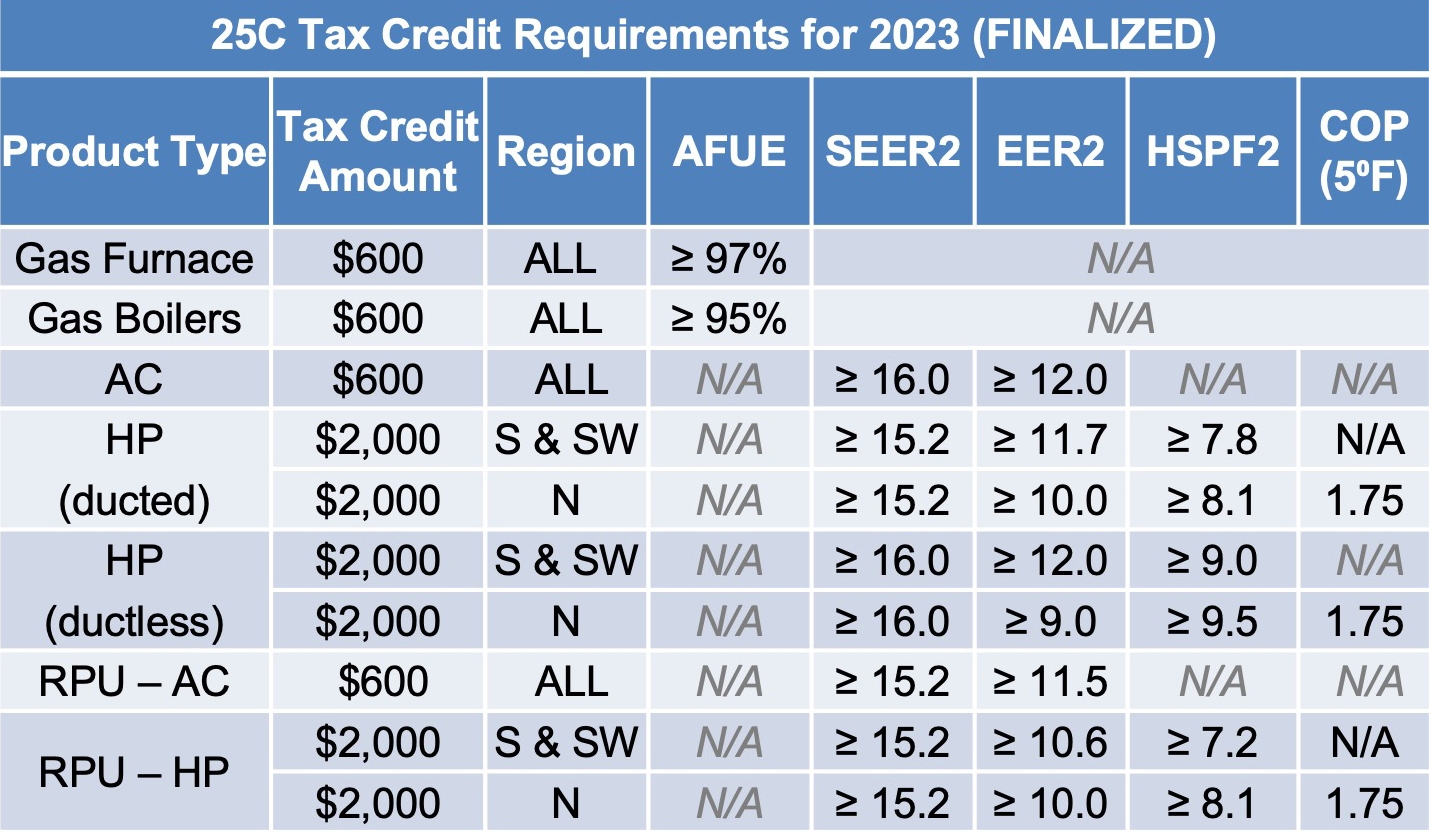

Source: www.lennoxpros.com

Source: www.lennoxpros.com

HVAC Federal Tax Credits & Rebates LennoxPros, But beginning in 2023, you could be eligible for a tax credit of up to $2,000 for qualifying heat pumps and heat pump water heaters under the new tax guidelines included in the. These can cost from $2,500 to $10,000 depending on the size of the system, according.

Source: raviniaplumbing.com

Source: raviniaplumbing.com

Is There a Federal Tax Credit for Heat Pump Installation? RAVINIA, Larger federally funded rebates might become available in 2024, though. The inflation reduction act (ira) has.

Source: www.pumprebate.com

Source: www.pumprebate.com

Heat Pump Requirements For Federal Tax Credit, Starting in 2023, the 25c energy efficiency tax credit will give you up to 30% back on of the purchase and installation cost of qualified home upgrades (as well as a few other related energy efficiency tasks, such. Larger federally funded rebates might become available in 2024, though.

Source: surfside.services

Source: surfside.services

Energy Efficiency Tax Credits Heat Pumps & More, The 25c and 25d tax credits incentivize household electrification by lowering the total cost of qualified electrification upgrades. Families who install an efficient electric heat pump for heating and cooling can receive a tax credit of up to $2,000 and save an average of $500 per year on.

What Is The 2023 Federal Tax Credit For Heat Pumps?

But beginning in 2023, you could be eligible for a tax credit of up to $2,000 for qualifying heat pumps and heat pump water heaters under the new tax guidelines included in the.

The 25C And 25D Tax Credits Incentivize Household Electrification By Lowering The Total Cost Of Qualified Electrification Upgrades.

Households looking for assistance today may be eligible for other federal programs, including tax credits or the weatherization assistance program.